Altcoin.io

Altcoin.io Press Mention: Cryptocurrency Exchanges - The Block Crypto

follower @ Altcoin.io

Published on Aug 30, 2018

Campaign ends Friday August 31st: https://wefunder.com/altcoinio

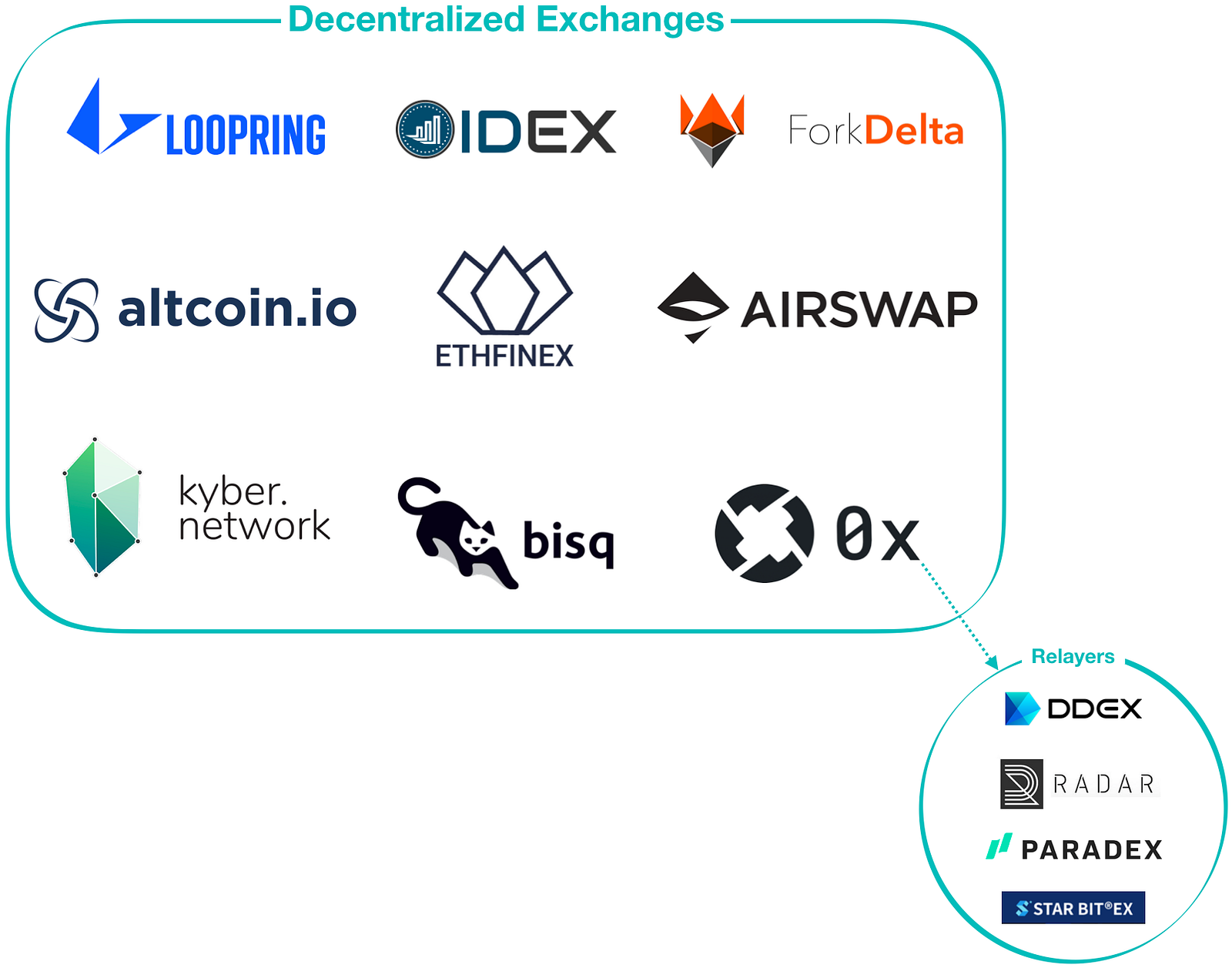

"Block by Block is a series where we dive into different industries and examine the entry-points for decentralization. To read more, visit The Block and subscribe to our newsletter. As often as members in the crypto-community tout "decentralization," there is still one truth: centralized cryptocurrency exchanges are kingmakers in this ecosystem.

What are the barriers to entry?

While many entrepreneurs are building DEXs, early stats show that is still a lack of activity on these exchanges. According to DappRadar, over a span of 24 hours, the top 5 DEXs on Ethereum processed ~6,877.54ETH in volume — roughly $1.9M. In comparison, the 24-hour trading volume of centralized exchanges is over $2.9B. In other words, the top five DEX’s have 0.0641% the trading volume that the top five centralized exchanges have.

There can be a number of reasons for this lack of use:

Functionality: Compared to centralized exchanges, DEXs have limited features. For example, DEXs rarely have different order types (stop losses, limit orders, etc.). Additionally, the user-experience of DEXs are often unfriendly for the average user.

Speed: By their very nature blockchains are slow databases. This leads to slow trades (transactions) on DEXs as all transactions have to be processed by miners on the blockchain.

Lack of liquidity: Exchanges are marketplaces, and marketplaces need network effects to operate. Because DEXs are relatively new to the cryptocurrency exchange space they fall into the chicken and egg problem — traders join highly liquid exchanges but for exchanges to be liquid they need traders to join."