Launch Guide

Before Launching Activating Crowd Messaging Educating Momentum Analytics Legal Issues Exercises ← Other FAQsYou know how great your business is, your family has heard it more than a few times, but most people have no idea who you are or what you're doing.

This guide outlines the tactics for a successful crowdfunding campaign. Use these strategies to ensure your megaphone is as loud and crisp as possible. There are thousands of potential investors out there—let’s make sure they hear your story.

- Before You Launch: Nothing is more compelling than seeing hardworking people building what they love. Start with a great story and beautiful profile.

- Activate Your Current Circle: Already have customers? They’re obviously believers—so get them pumped. Give them the chance to own a piece of the company and kick off your fundraise with a bang.

- Messaging: Getting people to give up their time, much less their money is tough. To get either, you need to hit the right points that'll resonate with your audience.

- Educate: Equity crowdfunding is new. Potential investors must understand what they’re getting into. It’s easier to give someone hard-earned money when you know what’s going on.

- Analyze and Manage Momentum: Know who your ideal customer is? They’re probably also your ideal investor. Reach this demographic with press articles, targeted advertising, and well-timed Reddit posts. Then build the momentum and herd those investors fearful of missing out.

- Legal issues: Make sure you understand the law.

Pour another cup of coffee. This is it.

Before you launch

Hone your narrative.

“Make sure you are differentiating your company—are you a first, a best, or an only? You want to make sure the description you use can’t be used by any other company.” - Michelle Faulkner, BigSwing

Billboards, tweets, pop-ups, commercials—you are consuming all the time, everywhere. But when you get a chance to invest in something that’s not just consuming, that’s experiencing.

That experience is crafted through the narrative of the investment. “I bought a new wallet,” transforms into, “I invested in this amazing wallet company that created this new compostable material.”

Figure out your story, then shape your campaign around it. That narrative is what people are investing in.

Build out your pitch.

All potential investors will be funneled to your profile—we can’t stress enough how important a solid profile is. Video, visuals and transparency are all key. For an in-depth walkthrough on crafting your pitch check out our Pitch Guide.

Set up a timeline.

“Over prepare. That timeline of what you need to have in place before you launch is worth having on your wall, etched into your mind. It’s lack of preparation that crushes the best crowdfunding idea.” - Heather Delaney, Dynamo PR

Back in 2010, you could throw up a campaign on the internet and people would swim their way towards you. It doesn’t work like that anymore.

Before launching, you need these ducks in a row: first adopters, press, social media posts, videos, announcements. If you’re planning on a 60 day campaign, know where you want to be at Day 7, what update you’re going to tweet on Day 15, and so forth.

Line up your investors.

“Crowdfunding’s a paradoxical vehicle. You go on crowdfunding hoping to raise money, but if you haven’t raised the money, people don’t think it’s a good idea.” - Zach Smith, Funded Today

Day 1 of your campaign is like the Grand Opening of a restaurant, you want to make sure people show up and they’re excited. That gives the cue for passerbysto jump in and get a slice of the newest thing in town.

Before you launch reach out to your crowd—make sure they know you’re fundraising—and get them committed. By Day 7, you should have already achieved at least 30% of your funding goal.

Email outreach.

It could be a newsletter or a rewards program, you should have a list of names and email addresses in your arsenal (and should be continuously adding to it before and during the campaign).

Your customers are standing closest to the lip of the funnel—they’re already paying you for your services, the next step is to have them take that money and put it into the business directly. Email them first to introduce them to equity crowdfunding, and again on the day right before your campaign launches to remind them curtain opens in a few hours. Don’t spam.

Remember that narrative we talked about earlier? You need to apply that here and make your users feel privileged, unique, and expert. You’ll also have to teach them exactly what equity crowdfunding is since it’s such a new space. We outline that in the next section, Educating Your Users.

Connect with your friends, family, fans.

There’s a saying that the only people who participate early in business ventures are the 3Fs: friends, family, and fools. We think differently—that last F, represents your most loyal and fervent fans.

We talked about your mailing list, but likely you have a handful of customers who you know by name and are passionate about what you do. Reach out to those fans personally, activate their enthusiasm by bringing them onboard the campaign (“Hey, I’m running a campaign soon and would really like to know what you think about my profile. Do you know anyone else who’d be really interested in this?”)

Crowdfunding is powerful because users rarely have a chance to interact with founders on a meaningful level. This is that chance. Excited fans excite others.

Establishing social media presence.

"First you have to have a community, that's where it truly begins. Embracing the people around you is good, but they might not be your core audience. Find where your core audience hangs out online—are they on LinkedIn, Reddit? Be active there." - Roy Morejon, Command Partners

You don’t have to populate every social media platform available on the internet, but there will be a few that work best for your company. (Wefunder heavily uses Facebook and Twitter for content and Instagram for fun.)

Being active on social media allows you to show off your company values, receive user feedback, and channel traffic to your main site. It can also make your business seem bigger than it is. Josh Morton of Barrow’s Intense Ginger Liqueur credits social media for opening several accounts in bars around the country.

Get on the phone or meet in person.

After you've emailed someone—reporter or potential investor—give them a ring. Because no one calls anymore, you picking up the phone makes you stand out. Even if the person doesn’t answer, they’ll see your name or your number or hear your voice message—you’ve got a toe in the door.

We also recommend hosting events to talk about the facts. Have a crowdfunding party where you invite your customers or your friends and their friends. Get that facetime. It is much easier to convince someone of your drive when they can look you in the eye and hear the fire in your voice (just make sure you don't discuss the terms of your securities - see the legal section).

Take advantage of feedback.

“Perspective is a private experience. When you get into a crowdfunding campaign, it’s your baby. You get so attached you don’t recognize that perhaps the market doesn’t want it or it needs to be tweaked before it resonates. Fail fast, learn quickly.” - Zach Smith, Funded Today

Say you’re running a campaign for a purse company. Reach out to a friend on Facebook who’s really into fashion, share the campaign and your story. Ask them to invest on Day 1. If they agree, perfect. If they don’t, they’re likely going to still give you valuable information: “I wish the handles were blue.” “Your purses are kind of pricey.” “I just bought a purse from this other brand.”

When you try to get investments, don’t think about it as just collecting money. You’re collecting information. Use that to move fast, hone in, and perfect before the big day.

You need to hoist your community aboard and get the press a'buzzing, but getting them on the boat is hard. Much of it relies on how you paint the horizon.

Reaching out to users.

A lot of companies feel weird about soliciting users for money, but that's the wrong way to think about it.

You are offering your users an opportunity to become owners. These are the people who have believed in you since Day One and they deserve the chance to support that vision in a more intimate, powerful way. Give them a sense of ownership: an experience they'd never otherwise be permitted to have.

A founder once told us,"Regular crowdfunding is buying a product. Equity crowdfunding is buying a piece of the factory."

Reaching out to press.

There's one big question you need to answer for a reporter in a pitch email: "Why are you doing this?" There's a philosophical and a strategic answer.

The Philosophical Why

Equity crowdfunding allows your users to participate in your success in a more tangible, meaningful way than simply buying a product. They become both figuratively and literally invested in your company.

Take Oculus Rift for instance. In 2012, Oculus closed a Kickstarter round of $2.4 million. Two years later, Facebook bought Oculus for $2 billion. If those Kickstarter backers had invested instead of donating, they would have had a 154x return on their investment. And they would have deserved it, because they were the early believers who took that risk and had the faith.

The Strategic Why

When you give someone the identity of being an investor, they're going to do more than sit idly on the bleachers. They're going to be waving your banner and shouting at the top of their lungs.

By raising investments from the crowd, you now have a larger following who is going to source employees for you or share by word-of-mouth about product launches. You can harness that strength in numbers in specific ways that benefit your company.

After all, your users are already the exact profile of people who'd know other potential users. Making them investors means it's just that much more likely they'd go out on their own to find more people who feel the same way they do.

Equity crowdfunding is brand spankin’ new sector. That means most people won’t have a clue what it is, how it differs from regular crowdfunding, and why it’s so exciting. It’s your job (and ours) to help educate potential investors before they can participate in equity crowdfunding.

What is equity crowdfunding?

Equity crowdfunding means businesses can raise money from a large group of people at smaller investment amounts. In return, that group of people get a financial stake in that company.

So, what makes it different from Kickstarter?

On Kickstarter businesses are usually hosting pre-sales of their product or it’s donation-based crowdfunding. On Wefunder, you’re not donating money to a business. You’re investing.

What that means for investors, is you can now directly put capital into your favorite restaurant or your favorite bike company. You’re no longer just an avid customer, you’re an owner. And you get perks for that, too. For instance, discounts, food credits, free merchandise, etc.

What is the JOBS Act and what makes equity crowdfunding exciting?

May 16, 2016 marks the exact day when everyday Americans—not just the wealthy—will be able to invest in private businesses they love for the first time in over 80 years. During those 80 years, only the wealthy and well-connected had any say in which businesses got to flourish. Wall street had taken over Main Street.

But with equity crowdfunding, we’re democratizing capitalism again. You don’t have to be a millionaire to put in $100 in the café you go to every Sunday. You now have the power to directly support businesses you love—with an opportunity to make money on it yourself. We’re taking America back to being a nation of owners, not just consumers.

Reaching out to press.

Reporters receive dozens—if not hundreds—of pitch emails everyday. Got the “next big thing?” So does everyone else. Here are some tips to maneuver your way out of that sardine can:

Ditch the press release.

Press releases are a dime a dozen. Instead, personalize your email for every reporter you reach out to, and focus more on writing an engaging, punchy subject line. If you can’t get a reporter to open an email, you’ve already lost.

Give them a call.

“A lot of the time, reporters won’t answer their phones, but they’ll see that you called, and they’ll listen to the message, and if they’re interested they’ll go find the email and they’ll get back to you.” - Michelle Faulkner, Big Swing

Remember, no one calls in this day and age. Which means by doing so, you already stand out.

Conquer the puddle, then the sea.

Let’s say I’m based out of Park City, Utah. I pitch to my local paper first, leveraging that fast raise I did in the first week.

Once I’m in the community paper, I gain more traction and pitch the local paper for Salt Lake City, Utah, saying “Hey, look I was in these newspapers.” After that, I pitch for a bigger paper on the west coast, and so forth. Start small, pitch up.

Convince the influencers.

“You should be laser focused on the outlets in which you know your target audience are sitting and make sure you are raising the awareness there.” - Heather Delaney, Dynamo PR

Not every person in America needs, much less is looking for, something like a mountaineering tent. But that doesn’t mean you can’t run a successful campaign. The key is to find your potential customer base, find the person who has access to that customer base, and target that person.

For instance, a camping blogger or an owner of a popular outdoors shop. If you bring on board leaders, they will bring their following with them.

Manufacture your own second wind.

Schedule your updates.

Strategically parse your press throughout the campaign. No news means less eyeballs, meaning higher chance of investment drops or plateaus. Have some sort of major update—new blog post, video clip, interview—ready at least once a week. Add chapters to your story.

Stretch goals

One way to spin your progress is by setting stretch goals. Your original funding goal should be the minimum of what you’re looking for—and you should reach this earlier on in this campaign. It gives you the soundbite: “We hit our goal of $100k within two weeks! And people are still investing more.”

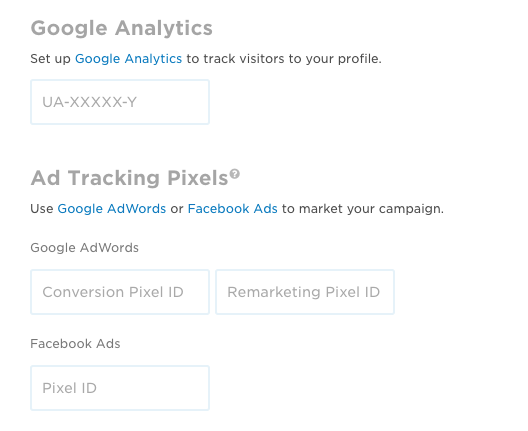

When you fundraise, you can plug in your own Google Analytics to track profile views and investments. Or if you want to run ads on Google or Facebook we support conversion pixels, too.

Here’s the how-to on running analytics during your campaign

Google Analytics Installation Guide

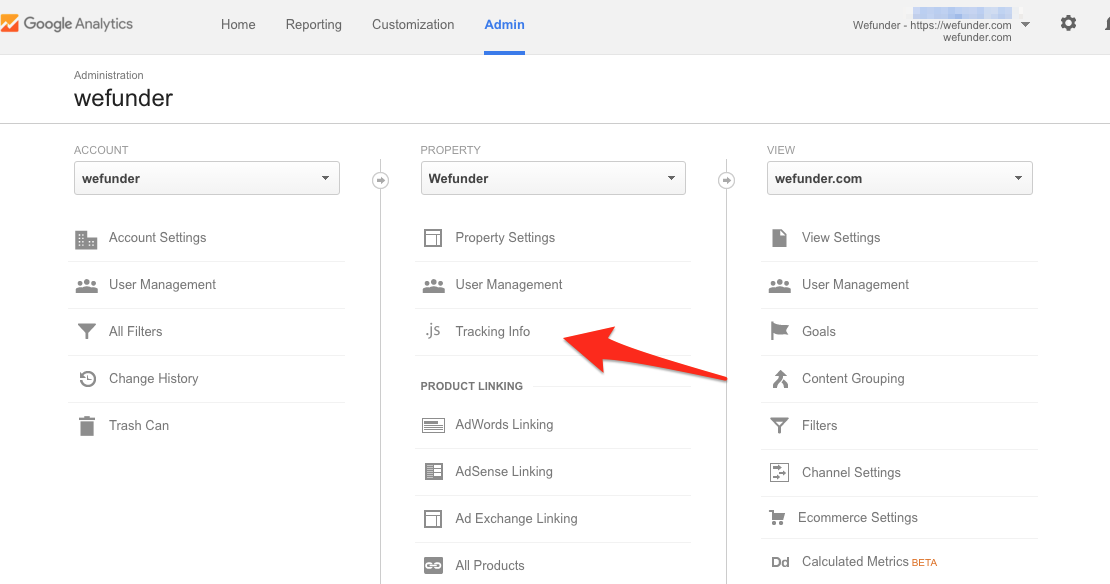

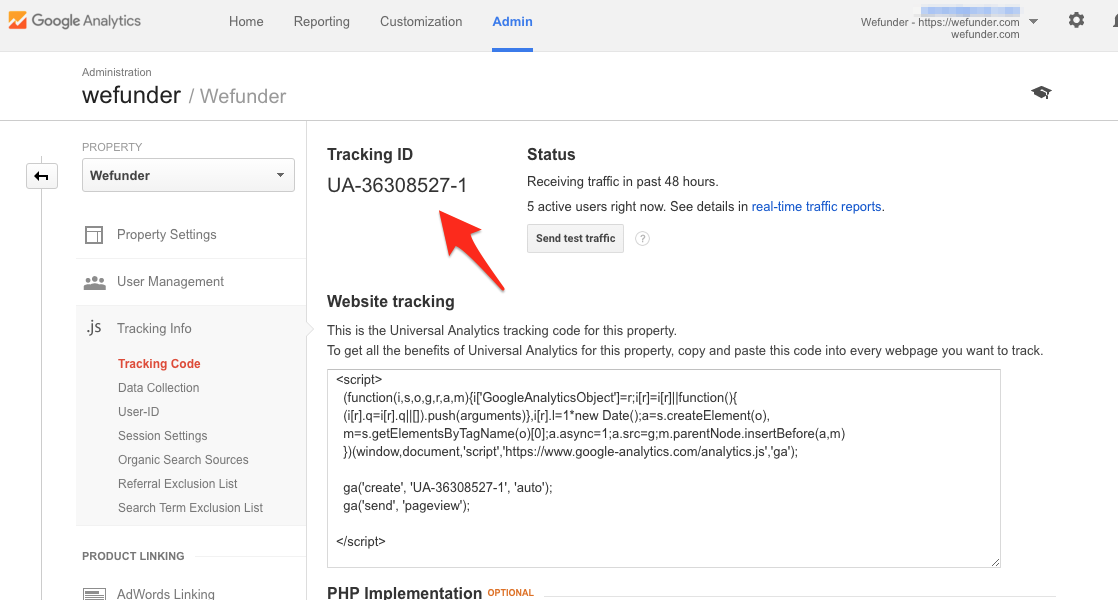

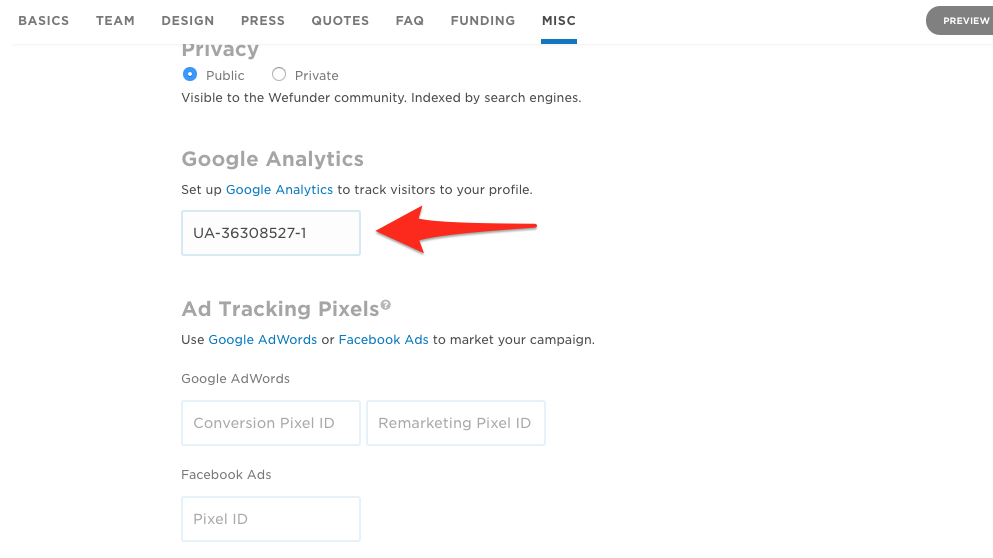

If you use GA then all we need is your Tracking ID. You can find that by going to your Google Analytics Admin page, click Tracking Info, then click Tracking Code, then copy your Tracking ID., then edit your company profile and paste it into Misc > Google Analytics.

Easy Peasy.

You can verify that the tracking pixel is working correctly by returning to your profile and looking at your Real-Time traffic.

We’ll send you the following traffic:

/wefunder-analytics/

/viewed_profile

Triggered when someone visits your profile./wefunder-analytics/

/viewed_invest

Triggered when someone clicks the Invest button./wefunder-analytics/

/completed_invest

Triggered when someone submits an investment application.

Note: You may see more completed_invest actions than what’s in your founder dashboard. Sometimes investors cancel their investment, sometimes our system hides the investment because it does not look legitimate, sometimes the investor needs to take further action before the investment is truly complete.

Pro Tip: Create a new GA Property just for your Wefunder campaign if you want to separate your crowdfunding analytics from your website analytics.

Campaign Tracking (Advanced)

We’ve added support for utm-like parameters so you can segment your Wefunder traffic and figure out which promotions are driving the most investors.

If you include wf_campaign, wf_source, or wf_medium parameters to your Wefunder profile URL we’ll pass corresponding utm_campaign, utm_source, and utm_medium parameters to your Google Analytics pageviews.

So for example, visiting the company profile– https://wefunder.com/democat?wf_campaign=demo

Will trigger the pageview– /wefunder-analytics/democat/viewed_profile?utm_campaign=demo

This can be super useful for you marketers out there!

Conversion and Retargeting Pixels (Advanced)

We also support Google AdWords and Facebook Ads tracking pixels. If you provide a retargeting pixel, we’ll include it whenever someone visits your company profile. And if you provide a conversion pixel, we’ll include it whenever someone completes an investment.

Google Adwords

We support conversion and retargeting pixels.

You can find the ID for both of these from their installation instructions. You’ll want to look for the google_conversion_id variable, like here:

The Conversion Pixel ID for this is “990947770”

Fun Fact: we’ll also pass in the investment amount to the conversion event as it’s value.

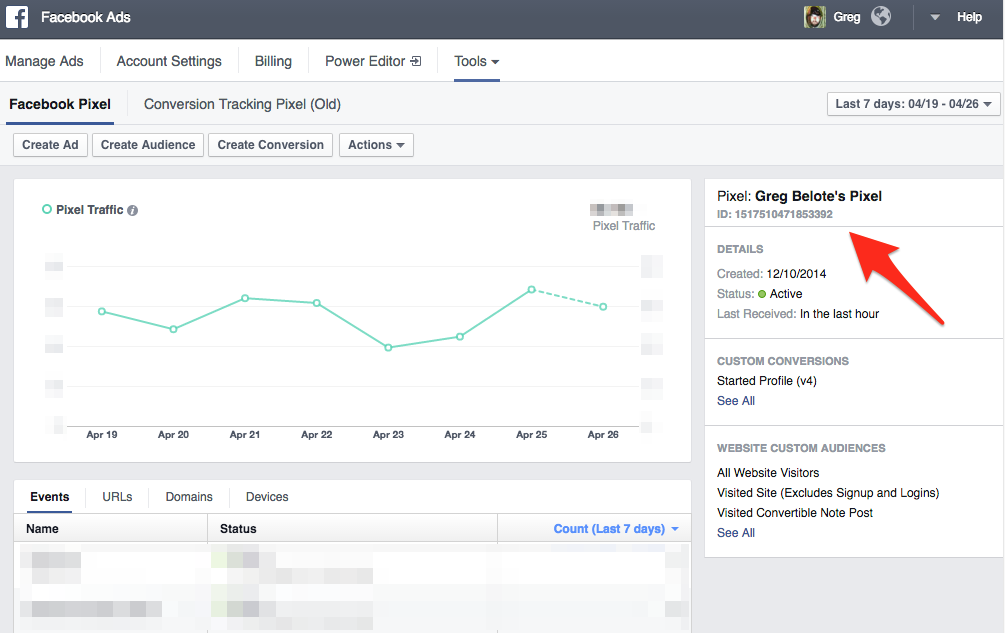

Facebook Ads

We support the Facebook Pixel. In order to find the Pixel ID you can go to the Ads Manager > Tools > Pixels page (direct link) and find it on the right sidebar.

We’ll trigger three events for you: wefunder:viewed_profile, wefunder:viewed_invest, and wefunder:completed_invest. From these you can create conversions or audiences.

Fun fact: we’ll also pass in the investment amount to the wefunder:completed_invest event as a USD value for the event.

Legal Warning

It is illegal to compensate someone based on whether they get others to make investment. So for example, you cannot pay a marketer based on the number of investors he brings to your campaign.

It’s bad if you violate this rule so I’ll repeat it for clarity: you cannot pay someone a performance fee that is tied to whether someone purchases a security.

Am I allowed to promote my fundraising?

It depends on which fundraising regulation you choose to use.

You are allowed to promote if you use Regulation Crowdfunding, Regulation D Rule 506(c), or Regulation A+. You are not allowed to advertise if you use Regulation D, Rule 506(b).

When am I legally allowed to advertise?

For Regulation Crowdfunding, you are only allowed to promote after your Form C is filed with the SEC. Oh, and never say the SEC has "approved" your offering. They don't like that.

You are allowed to advertise anyway you like - email, Facebook, shouting off the rooftops, etc. However, all your advertisements must be limited to factual information (i.e., avoid "invest in the best donut shop in the world"). Also, by law, all of your advertisements must include a link to your Wefunder profile.

What can I say (or not say) in 'real life' to the public?

For Regulation Crowdfunding, you are allowed to talk to the public about the facts of your business or products, provided you do not mention the terms of your fundraise. The SEC's final rules on Regulation Crowdfunding are clear on this point:

In addition, the final rules do not restrict an issuer’s ability to communicate other information that might occur in the ordinary course of its operations and that does not refer to the terms of the offering.

If a stranger walks into your store and chats you up about investing, feel free to answer their questions about your business. You must, however, point them to your Wefunder profile to see the terms and make an investment. And don't say non-factual things like, "We're the best donut shop in the world and we're gonna grow HUGE!"

For 'Demo Days', you can mention you are on Wefunder during your presentation if you keep your presentation limited to facts and say nothing about terms. Most credible demo days - such as those organized by Techstars or Y Combinator - already do not let their participants mention they are selling securities (or the terms of their offering) so as to not be deemed a 'general solicitation' of securities that is forbidden for most Regulation D offerings.

That same rule applies for conferences. You may mention you are on Wefunder if you limit your discussion about your business to facts and do not mention the terms.

Can I compensate marketers who send me investors?

It is illegal to compensate someone based on whether they get others to make investment. So for example, you cannot pay a marketer based on the number of investors he brings to your campaign.

It’s bad if you violate this rule so I’ll repeat it for clarity: you cannot pay someone a performance fee that is tied to whether someone purchases a security.

Always Build Relationships

"Be honest and be transparent. Every time you talk to a journalist, you should be building a rapport and engagement with that individual. They know who you should know. - Roy Morejon, Command Partners

It's easy to approach every journalist as just that—a reporter doing their job. But you have to leverage the network. That article you talked about might be coming out next week but maybe six months later you're going to need someone to cover your product launch in a different city. More than likely, that reporter will know someone.

And don't forget these relationships are symbiotic. The reporter isn't just putting you in the paper, you're giving them a good story and that's valuable.

The Message Matrix

“Identify who your key stakeholders are. You need to come up with a story for each of those stakeholder groups.” - Michelle Faulkner, Big Swing

Let’s say you’re making plastic razors that are 100% recyclable and for each razor you sell, you’re giving one away to someone in need.

There are different groups you can target—consumers, environmentalists, philanthropists—and for each group, you need to match the angle of your story. That’s the “message matrix.” Consumers want to know how good the razor is, environmentalists want to know how your razors are made, etc. etc. Michelle of Big Swing says before any big campaign, you should understand what groups you can appeal to and come up with specific messaging to interest them.

The Crowdfunding Success Matrix

Zach Smith of Funded Today attributes a successful campaign to two factors: product and marketing. Bad product, bad marketing is Outer Darkness…and so forth.

What’s key is that if you don’t have good marketing, if you don’t Maintain Momentum, no matter how good your product, your campaign will be at best a shooting star: fleeting.

Marketing throughout your campaign (getting press features, new users, partner announcements) is what’s going to help you hit your first goal fast, then exceed it two, three times over.

Be Available

“It is incredibly rare for a person to have this sort of access to a founder, and you will need to ensure you have someone monitoring the comments at all times and capturing the crucial feedback. This well help shape your company moving forward.” - Heather Delaney, Dynamo PR

If you’ve done your preparation before the start of your campaign, you should be able to spend your time during the race with your investors. These are people who “not only support your company, but truly believe in your success so should be treated with respect and gratitude.”

Once live, monitor—if not you, a team member—the campaign for any questions, comments, or suggestions your community puts forward.

1) These numbers include startups currently live on Wefunder if they pass their minimum target.

2) Some startups use two different laws at the same time (i.e., Regulation D and Regulation Crowdfunding).

Invest in the founders you believe in

Join over 1 million investors who are funding the future

Wefunder means Wefunder Inc and its wholly owned subsidiaries: Wefunder Advisors LLC and Wefunder Portal LLC. This page is hosted by Wefunder Portal LLC.

Wefunder Portal LLC is a member of the Financial Industry Regulatory Authority (FINRA). Wefunder Portal LLC is located in Gun Barrel City, Texas.

Disclosures

wefunder.com is a website owned by Wefunder Inc., the parent company of Wefunder Advisors LLC and Wefunder Portal LLC. Wefunder Inc. operates sections of wefunder.com where certain Regulation D and Regulation A+ offerings are available. Wefunder Inc. is not regulated in any capacity, is not registered as either a broker-dealer or funding portal, and is not a member of FINRA or any other self-regulatory organization.

Wefunder Advisors is an exempt reporting adviser that makes filings with the SEC and certain states. Wefunder Advisors advises special purpose vehicles (SPVs) used in certain Regulation D offerings that are available on wefunder.com.

Wefunder Portal is a funding portal (CRD #283503) that is registered with the SEC and is a member of FINRA. Wefunder Portal operates sections of wefunder.com where certain Regulation Crowdfunding offerings are available. For Reg CF investments, Wefunder Portal may charge issuers up to a 7.9% fee. Anyone with a financial stake in a company fundraising on Wefunder, such as a promoter, employee, or founder, must disclose their relationship when communicating with other investors. Investors should read our educational materials on startup investing. Educational materials are continually updated at https://help.wefunder.com.

By using wefunder.com, you accept our Terms & Privacy Policy. If investing, you accept our Investor Agreement. You may also view our Privacy Notice.

All investments involve risks, including possible loss of capital.