Cloudastructure

Facial Recognition, AI, Machine Learning for Cloud-based Video Surveillance

Highlights

Our Team

I was running a venture backed company in San Francisco in the dot-com boom. We got ripped off, went to see the video and ... it was gone. Someone had unplugged the on-premises system, it wasn't monitored, nothing in the cloud, and we thought this was an old model back then. Now it's ancient but is still the standard.

$30M+ raised to date from strategic investors and Reg A+ financing The Security Industry is massive.

Q: How many Enterprise Buildings have security cameras?

A: Just about all of them.

Even though video surveillance is a 10-figure industry, manned guarding is still three times as large as video surveillance. What if you could make the camera systems smart enough to do things even human guards can't do?

The guard at the front desk is doing two basic things:

1) does your face match your badge? (or did someone steal your badge and is badging in as you right now), and

2) when you badge in, is someone "tailgating" in behind you?

We are working on doing that on not just the front door, but the side doors, back doors, document rooms, server closets... all the doors. 24/7. Computers never sleep.

THE FUTURE IS MORE INTELLIGENT

Cloudastructure centralizes the management of site security and allows businesses to scale geographically. With Cloudastructure, professionals can search security footage the way people search the web: by tag (animal, vehicle, person, etc.) or even by face.

Because the door and cameras are all powered by AI, our system is constantly learning what badge holders look like, even as they change makeup, facial hair, glasses, etc. over days, months or years. We can match faces to badges more accurately than any guard.

How bad are current systems?

We hacked our way into major Silicon Valley campuses.

Your RFID badge can be copied easily— from only a few feet away. Watch us do it here.

Think that's bad? When our CEO was at Google in 2015 they had the "Tailgator". It was some poor guy dressed up in an alligator suit. When you badged in, he would try to "tail gate" in behind you, without a badge. Dressed as a ridiculous alligator. At the all-hands meetings every Friday they'd roll the video of who let the Tailgator in that week. This is one of the most technologically advanced companies on the planet using alligator suits to try to improve their security.

Wouldn't it be better if , when you let someone in behind you, that you just got an e-mail a minute later saying "Here is the video clip of you letting in someone without their badge. Please click here to acknowledge receipt of our security policy". That would change more behavior in a week than an army of Tailgators.

We're the last two servers to move to the Cloud.

Every company used to have an IT closet full of servers. Those servers have been moving to the cloud, and making each of these new SaaS providers billions of dollars in the process. Every building of every company has two servers still left in that closet: access control and video surveillance. Cloudastructure is moving these last two to the cloud. Once the data is in the cloud, we can perform our AI functions.

STATE OF THE ART TECHNOLOGY

Cloudastructure hardware utilizes state of the art technology, delivered at a competitive total cost of ownership, with technology that beats industry standards. It takes a combination of Computer Vision, Artificial Intelligence, Machine Learning, Cloud, and even IoT to do what we do.

Business Model: Saas (recurring revenue)

We found that we can compete with the incumbents by pricing by the door and camera per year. We make more recurring revenue than they do while still providing a lower TCO (Total Cost of Ownership) to our customers. However, we believe our higher level AI features will allow us to achieve security guard level pricing -- which is much higher than what we charge now. We intend to benefit from this price elasticity.

The Cloudastructure hardware utilizes state of the art technology, delivered at a very competitive price that beats the industry standards and comes with zero maintenance or replacement costs with a lifetime warranty. Cloudastructure solution centralizes the management of access control with video monitoring and allows customers to scale geographically to multiple locations.

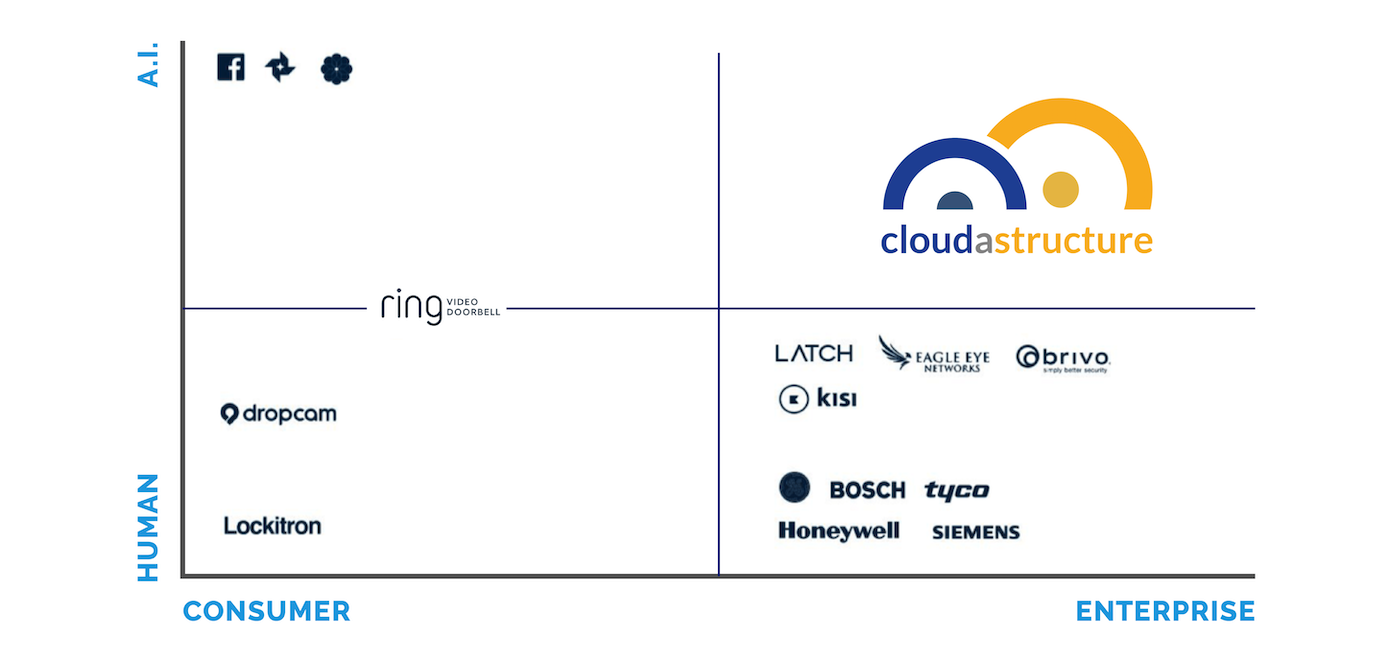

We're bringing AI for security to enterprise customers