Invest in Nostro Corp.

We aim to transform cryptocurrency from a speculative asset into a valuable part of the real economy

Highlights

Our Team

We’ll integrate $2.5 trillion worth of crypto assets back into the real economy

Problem: Cryptocurrency Is Out Of The Real Economy

Full version video 74 min at Youtube.

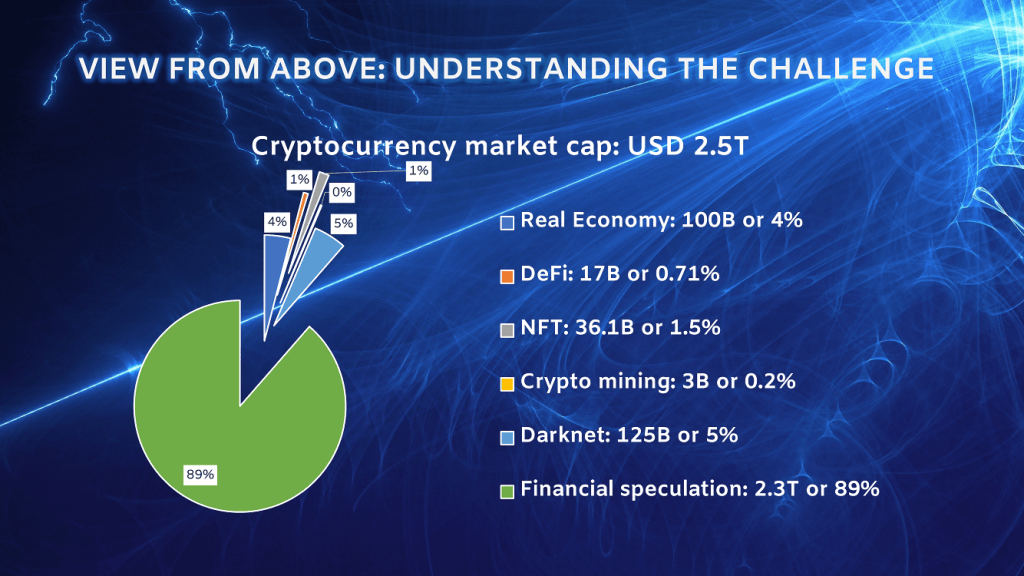

The cryptocurrency market capitalization is $2.5 trillion. The market volatility of cryptocurrencies is approximately $1 trillion. Currently, the market is growing. The capitalization may reach three trillion and set new records.

At the same time, the number of active users is 550 million. The margin of error can be up to 20% due to anonymous wallets.

There are 360 million legal entities worldwide, or 350 million business entities excluding non-profit organizations.

Only 16,000 business entities accept cryptocurrency as payment, representing 0.0045% of all businesses. It’s easy to see that this figure is significantly small compared to the overall number of legal entities. There are approximately 15,000 cryptocurrencies or altcoins in the market worldwide. With 15,000 cryptocurrencies, most businesses accepting crypto are likely altcoin developers.

89% of the total capitalization is financial speculation. Financial speculation is a zero-sum game, albeit on a massive scale. The fact that key players in the market are Financial Group Charles Schwab or BlackRock does not negate this fact. On the contrary, Wall Street’s entry into cryptocurrencies exacerbates the problem. Ultimately, 2.5 trillion is money withdrawn from the real economy. The problem has another aspect that should not be forgotten – resources. All these servers, computing power, IT infrastructure, and support staff – require more and more resources, with zero benefit to the real economy. All this effort is just so that distributed computers around the world can confirm yet another meaningless transaction after a few teraflops.

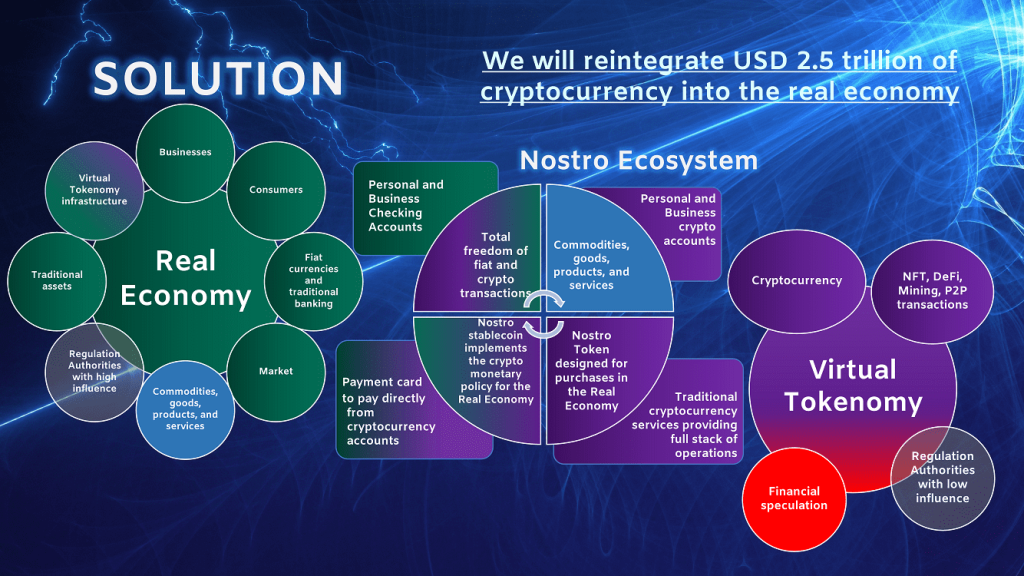

Solution: The Concept of Nostro Ecosystem

The Nostro Ecosystem comprises four key features that enable the reintegration of cryptocurrencies into the real economy. Primarily and most importantly, it offers total transaction freedom between all parties.

In essence, Nostro bridges the economy and tokenomics through a stable currency that functions equally well in both environments and through next-generation regulation based on the same principles as the Federal Reserve, with adjustments for cryptocurrencies.

The next two key features of the Nostro Ecosystem are the Nostro Token, designed solely for use as legal tender in the real economy, and the Nostro Coin, which implements monetary policy similar to the US Federal Reserve.

Four Keys of Nostro Ecosystem

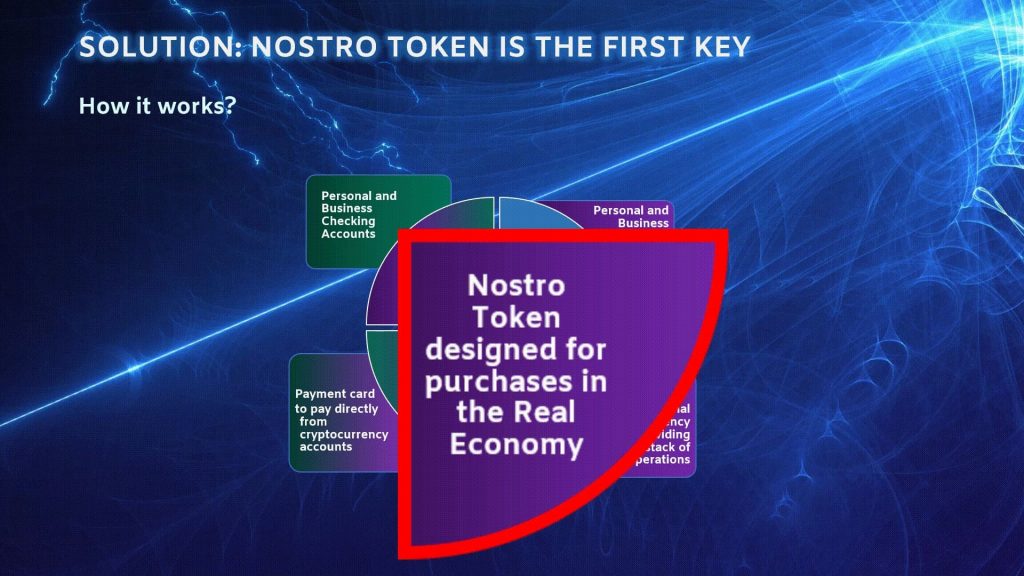

FIRST KEY is Nostro Token

Nostro Token is one of two stablecoins in the Ecosystem, with a fixed exchange rate of 1-to-1 to the Euro (EUR).

The main function of Nostro tokens is interaction with the real economy. N-tokens are designed exclusively for conducting business in cryptocurrency. Raw materials, commodities, goods, products, and services will effectively bought and sold using Nostro tokens. Nostro provides a convenient interface for making purchases and transactions both online and offline. Typical use cases include traditional paper contracts with cryptocurrency credentials of counterparties, scanning a retail product’s QR code and paying via phone, paying at a supermarket checkout with a payment card linked to a Nostro token account, and so on.

So, the issuance of the N-token occurs at the moment of its purchase with fiat or other cryptocurrencies. During this process, the corresponding amount of fiat or cryptocurrencies from the client’s account is transferred to a special settlement account of Nostro Corp, after that the Nostro tokens are issued and immediately credited to the user’s settlement account. The next simple way to acquire Nostro tokens into one’s account is a crypto transaction, where previously issued Nostro tokens are transferred from the sender to the recipient.

The reverse operation is token withdrawal into fiat. This can be done any time at a rate of 1-to-1 to the Euro. During this process, Nostro tokens are destroyed, and the corresponding amount from Nostro Corp’s settlement account, minus the commission, is credited to the client’s account.

The key point is that businesses can accept payment in tokens only if they have a sufficient amount of Nostro Coins, the second key currency of Nostro, in their account, which we will discuss on the next slide. Otherwise, the transaction will be declined.

The rules governing Nostro Token usage come into play solely when a business opts to accept payment and a client elects to pay using Nostro Tokens. Within the Nostro Ecosystem, businesses can receive payments, and clients can make payments using any available cryptocurrency, subject to standard fees for that cryptocurrency, or through fiat currencies, subject to standard fees applied to fiat accounts.

Finally, in the case of non-profitable or non-commercial transactions involving Nostro Tokens, the recipient does not necessarily need to have Nostro Coins in their account. Examples of such transactions could include token transfers from businesses to charitable organizations, P2P transfers between individuals, salary payments to company employees, freelancers, or contract workers, interest-free loans returned to company employees, transfers between non-profit organizations, and so on.

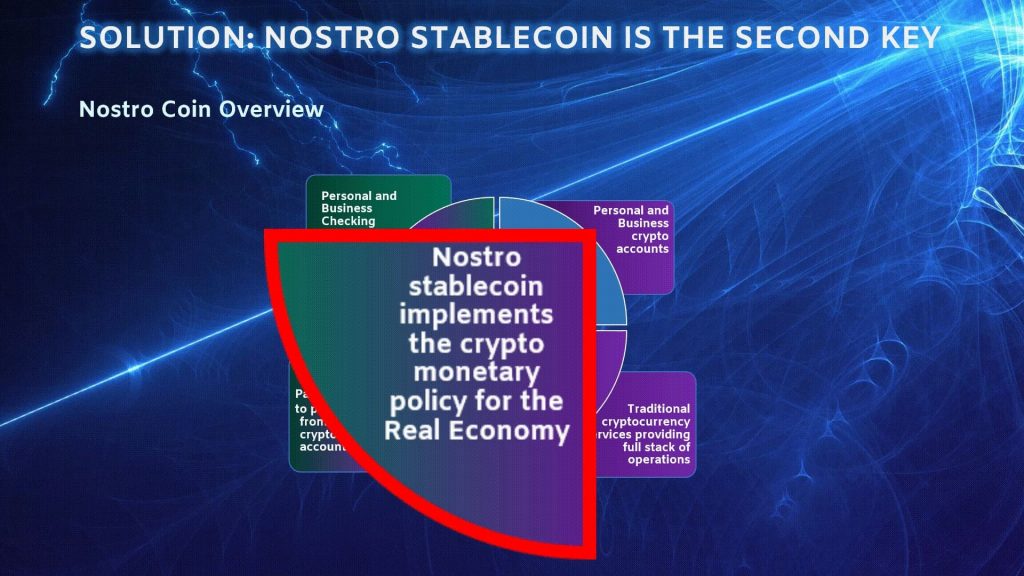

SECOND KEY is Nostro Coin

Nostro Coin is the second of two stablecoins in the Nostro ecosystem, with a fixed exchange rate of 1-to-1 to the Euro (EUR).

N-Coin is a key element of the monetary policy of the Ecosystem, as all instruments equivalent to those of the US Treasury and Fed Reserve are denominated in N-Coin. Despite N-Coin being a stablecoin with a fixed fiat withdrawal price, there may and will be a market rate for Nostro Coin, determined by market players, as the coin serves several crucial functions and is constantly in demand. The market rate never falls below the nominal value of one euro, as Nostro exchanges the coin at a nominal value for fiat currency.

Both businesses and individuals can have Nostro Coin in their accounts without limitations. However, for businesses, the functionality of Nostro Coin is expanded.

First and foremost, N-Coin is equivalent to the business turnover within a unit of time. In other words, if a business has one million Nostro Coins in its account, it means that within a specific unit of time, such as a month for example, the company can sell goods worth one million Nostro Tokens. However, if a new transaction arises after this volume is exhausted, it will be rejected because it exceeds the allowable turnover. At the end of this unit of time the business can sell goods worth one million Nostro Tokens again. Essentially, by purchasing Nostro Coins, the company is acquiring its potential sales volume.

Of course, businesses may not have any Nostro Coins at all or have an insufficient amount to complete a transaction and close a deal. In such cases, businesses can borrow Nostro Coins from Nostro or other participants. This debt will also be denominated in Nostro Coins. The minimum funding rate is set by Nostro. Any participant can set their commercial rate for providing short-term loans, but the commercial rate cannot be lower than the Nostro Rate. Essentially, this means that Nostro provides the cheapest loans within the Ecosystem.

Both businesses and individuals can use Nostro Coins as an investment asset. The price of the coin constantly rises due to its shortage in the market. This shortage arises from the desire of businesses to sell more and more, as well as the desire to avoid overhead costs associated with borrowing coins. Thus, owning Nostro Coins increases the capitalization of businesses and allows individuals to earn by selling coins at the market price, which can significantly differ from the nominal value of one euro. Nostro Coin can be likened to a gold coin. The purchasing power of a gold coin is expressed by its nominal value, while its market price fluctuates with the market price of gold.

THIRD KEY is Nostro Blockchain

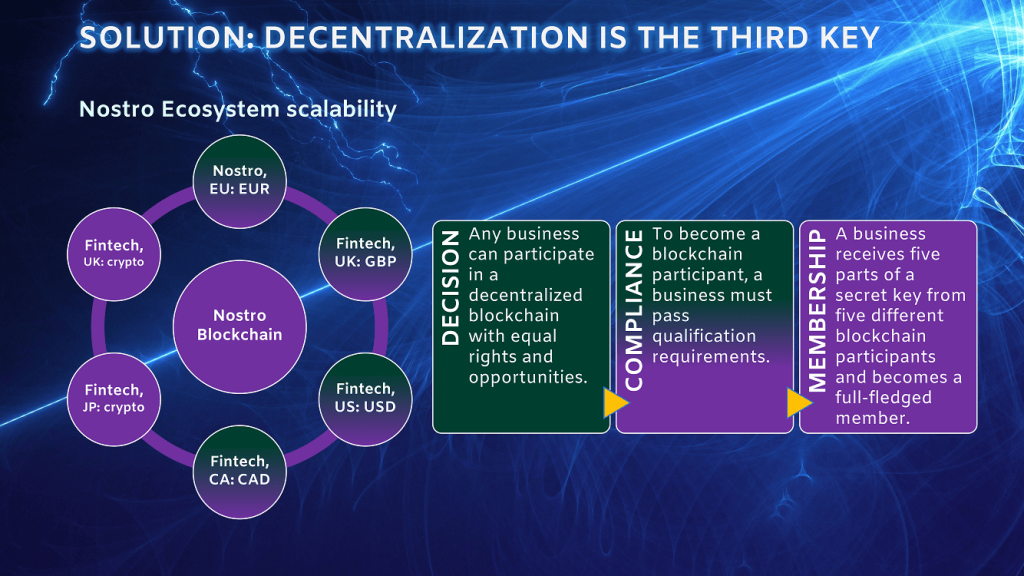

Nostro’s blockchain is designed so that any business can clone Nostro’s capabilities and start reintegrating cryptocurrencies into the real economy within its native jurisdiction.

Fintech companies in the USA, UK, or Canada, as blockchain participants, can issue their own pair of coin-tokens denominated in US dollars, UK pounds, or Canadian dollars, respectively. In addition to the core tools, these companies also will be able to conduct their own monetary policy by setting local rates and issuing securities. On the diagram, these companies are depicted with gradient color to emphasize that they are fintech companies capable of opening fiat checking accounts for participants in local currencies.

For example, other companies without financial licenses or with only crypto licenses can also easily become participants in the Nostro blockchain and conduct all crypto operations, including issuing core instruments.

Any business, regardless of location or jurisdiction, can join the Nostro blockchain network.

The initial step for every business is making a voluntary decision to join the network.

The next step is to meet the qualification requirements and compliance. Financial companies with the necessary licenses will undergo compliance much easier, simpler, and faster than non-financial companies. However, in the end, any business has the potential to join the Nostro blockchain as a participant, no matter if this is a financial company or not.

After successfully going through the compliance procedure, the participant will receive five parts of a secret key from five randomly selected existing participants located in different jurisdictions. With the secret key, the business gains full-fledged participation in the blockchain, unlocking all tools and opportunities.

It’s also important to note that a business doesn’t have to be a blockchain participant to open accounts in Nostro, leverage the full power of fiat and crypto accounts within the ecosystem, and sell real goods and services for tokens. Such a business is classified as a regular corporate client.

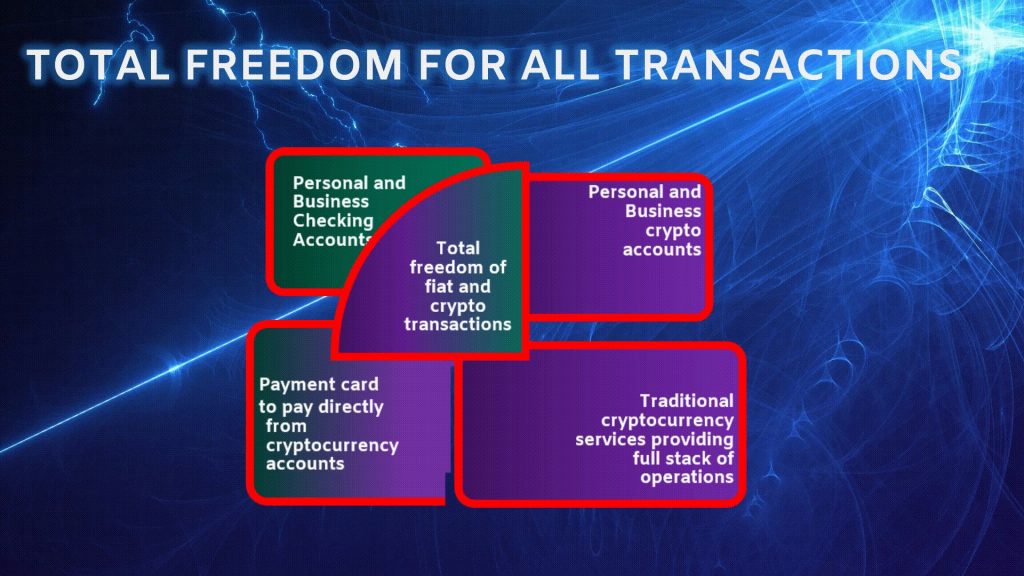

FOURTH KEY is Total Freedom Of Transactions

Nostro provides businesses and individuals with fiat and cryptocurrency accounts, without limitations on transactions except regulation requirements. This means that, for the first time since the inception of cryptocurrencies businesses can fully accept payment for their goods in crypto and pay suppliers and service providers, while individuals can freely use cryptocurrency from their wallets as they would fiat money.

Benefits of Transaction Freedom

- Full compliance with EU and US regulations

- Accounts for Businesses and Individuals

- IBAN

- Cryptocurrency

- Nostro Cryptocurrency (N-Token & N-Coin)

- Local and International wire transactions

- Local and International P2P transactions

- Nostro internal transactions

- Inbound and outbound local and international transactions are permitted with accounts under a name different from the account holder, regardless of whether those are checking or cryptocurrency accounts

- Available for residents and non-residents

- Support of the payment cards

- Visa/MC

- Traditional payment cards linked to the client’s IBAN account

- A crypto-linked debit card that allows direct payments from the client’s cryptocurrency account

- Support of the corporate cards

- Virtual and physical debit cards

- As many cards as necessary can be issued for one client

Nostro vs US Financial Authorities

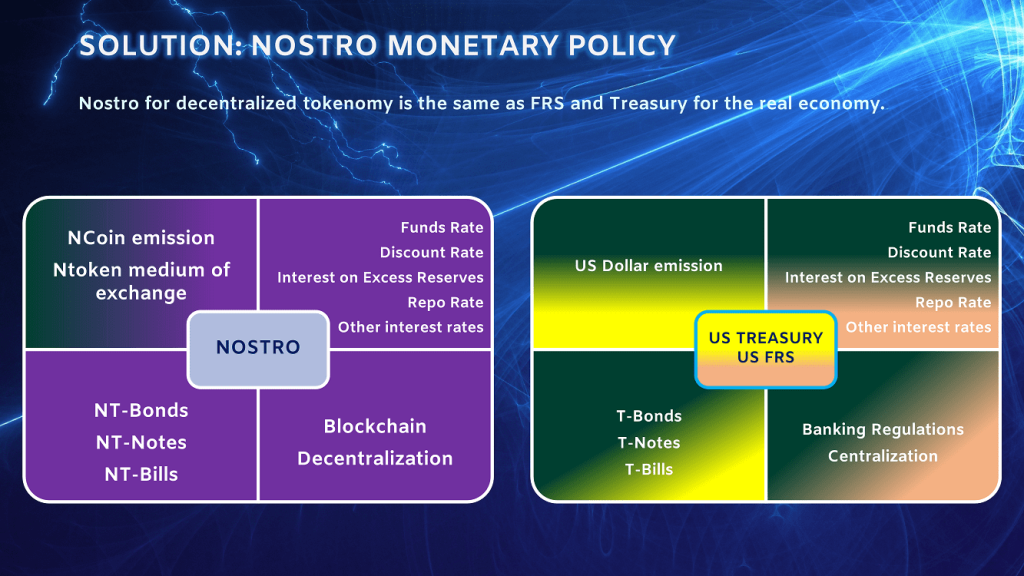

To make the integration of cryptocurrencies into the real economy possible, Nostro employs mechanisms similar to those used by the Federal Reserve System and the U.S. Department of the Treasury.

The primary and principal mechanism of the US Treasury is dollar issuance, while the Federal Reserve System (FRS) defines the key interest rates. Similarly, Nostro issues Nostro Coin and implements blockchain with functional support for Nostro Token. This pair represents the main currency of the ecosystem. Both currencies are equivalent to the euro in nominal value; however, Nostro Token has no market rate as it is created upon fiat money input and burned upon fiat money withdrawal. On the contrary, the Nostro Coin is issued by Nostro and is never destroyed. The token serves as a primary cryptocurrency legal tender to exchange for raw materials, commodities, goods, products, and services. Nostro Coin regulates business turnover and is a shortage asset. It is also used to implement Nostro’s monetary policy.

If a business lacks Nostro Coins for a transaction, it can borrow it from Nostro at the funding rate or from other ecosystem participants at a commercial rate, which cannot be lower than the Nostro Funds Rate. The implementation of additional types of interest rates and their applicable logic will be introduced in the later stages of system development. This tool is entirely analogous to the Federal Reserve’s rates.

Nostro has a mechanism for issuing securities denominated in Nostro Coins, similar to US Treasury securities denominated in US dollars. These capabilities will be implemented in later stages and are not currently discussed. It is worth noting that these securities will pursue the same goal as the US Treasury’s securities, specifically managing macroeconomic processes within the ecosystem.

The decentralization of the Nostro Ecosystem is the main difference from the Federal Reserve. In our blockchain, any number of banks similar to Nostro Bank can exist. For example, a financial company from the UK or Canada that meets our qualification requirements can create their own bank on our blockchain with similar tools for conducting monetary policy in British pounds or Canadian dollars for British or Canadian businesses, respectively.

Competition

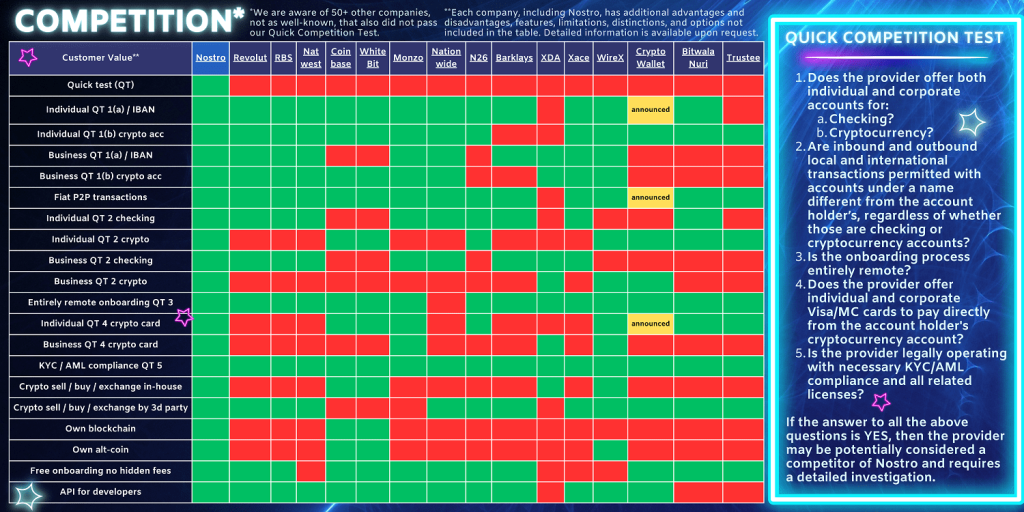

We have developed a quick five-point test for swiftly determining whether a company is a competitor of Nostro.

- Point one. Does the provider offer both individual and corporate accounts for:

- Checking?

- Cryptocurrency?

- Point two. Are inbound and outbound local and international transactions permitted with accounts under a name different from the account holder’s, regardless of whether those are checking or cryptocurrency accounts?

- Point three. Is the onboarding process entirely remote?

- Point four. Does the provider offer individual and corporate Visa/MC cards to pay directly from the account holder’s cryptocurrency account?

- Finally, point five. Is the provider legally operating with necessary KYC/AML compliance and all related licenses?

If the answer to all the above questions is YES, then the provider may be potentially considered a competitor of Nostro and requires a detailed investigation. Even large financial enterprises, such as Revolut or Wise, often do not meet these basic criteria. However, we consider these five points to be fundamental and necessary as they implement our principle of transaction freedom. Whenever you think another company has already implemented this feature, check our Quick Competition Test and be surprised to find out it’s unique to us.

As seen from the comparative table, even major players in the market do not pass our quick test. Of course, we do not expect this from conservative banks like Barclays or the Royal Bank of Scotland. However, online fintech companies continue to place unnecessary restrictions on their clients, including limiting cryptocurrency withdrawals exclusively to accounts held on licensed crypto exchanges under the same name as the account holder. The purposes of such transactions can be either speculative or investment-related. In any case, this has no relevance to the real economy. The situation is even worse with crypto fintechs for businesses. Although there are crypto companies targeting business clients, they face issues with supporting fiat accounts, making them unattractive for businesses.

Nostro is free from these defects and disadvantages.

Advantages

Our unfair advantage lies in the absence of transaction fees.

Nostro Token or Nostro Coin can be purchased with fiat money or other cryptocurrencies. When purchased with fiat money, the payment processing fee is charged by the Acquirer which is not the Nostro. In the future, we plan to launch our in-house processing, but at this stage, this fee is taken by the service bank that processes the fiat payment. Similarly, the third-party system processing payments in other cryptocurrencies charges a fee for crypto-acquiring.

Inside the Nostro Ecosystem, there can be millions of transactions involving the Nostro Coin or Token, and all of these transactions are completely free. In other words, raw materials, commodities, goods, products, and services can be bought or sold for tokens, users can make P2P payments to each other, businesses can buy and sell Nostro Coins, and all of these transactions will be free of charge.

Finally, converting to fiat or other crypto-assets also incurs a fee. Nostro earns this fee. In fact, by introducing this fee, we incentivize ecosystem participants to refrain from converting to other assets or at least minimize the number of such operations.

Another unfair advantage of Nostro is that in some cases the cashback can reach up to 100%. Overall, cashback is available for both individuals and businesses, but its calculation differs.

The key factor in calculating cashback for individuals is the number of purchases made using N-Token. This approach incentivizes individuals to use cryptocurrencies to buy commodities, goods, products, and services.

The key factor in calculating cashback for businesses, on the contrary, is related to the amount of NTokens returned back into the economy. Of course, companies can withdraw into fiat at any time, and the Nostro business model assumes full coverage of tokens with fiat reserves. However, we are interested in encouraging businesses to reuse tokens for paying counterparties’ services or for charitable transactions, such as donations to non-profit organizations.

Ultimately, participants receive cashback in the form of Nostro Tokens and can use them as they see fit, including converting them into fiat currency.

The forecast based on our market research shows that any business will increase its sales by at least 30% in the first year simply by accepting Nostro tokens as payment. Businesses do not need to change their business processes or adapt to our solutions. Opening an account in our fintech startup and starting to accept payment for goods in an additional currency is sufficient. By opening an account, the business automatically gains legal access to the entire cryptocurrency market and solutions in innovative virtual tokenomics. These solutions allow businesses to use fundamentally different principles that are increasingly impossible to ignore. Finally, the earlier a business starts adapting to cryptocurrencies, the more competitive advantages it will gain.

And what about the individuals? As for now, they will have the opportunity to earn cryptocurrency for the first time, such as receiving salary or contract payments and spending it on daily purchases. Nostro clients will also gain access to fundamentally new investment assets, the growth of which is based not on financial speculation or blind faith, but on market demand for these assets. The liquidity of these assets will constantly increase based on market demand, allowing individuals to earn passive income by owning them. Finally, financial speculation will naturally find its place in the new market, no longer posing an uncontrolled risk, as the real economy absorbs a larger share of cryptocurrency assets for its needs.

Profit Forecast

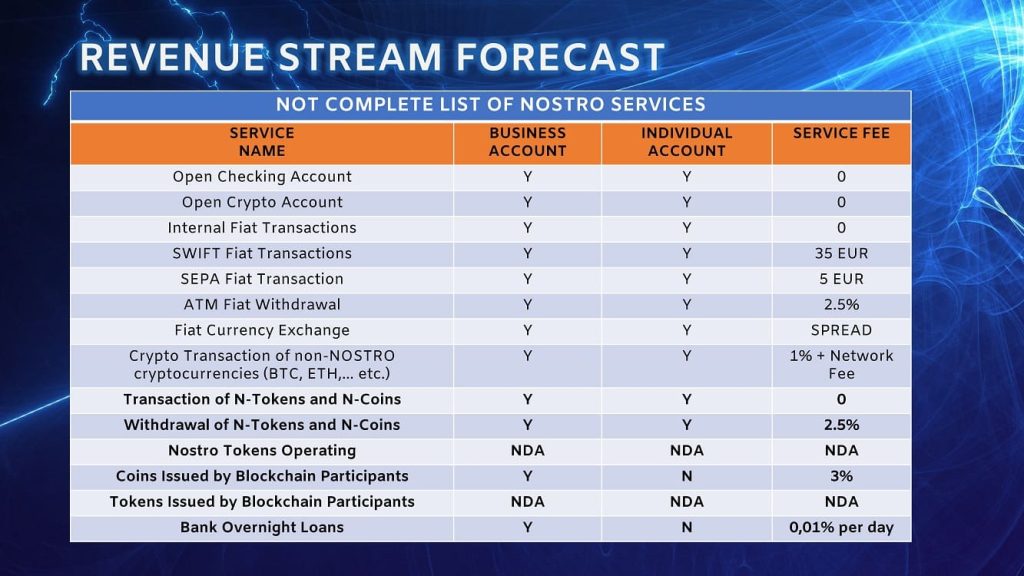

The first table shows only a portion of our paid services. Note that our exclusive services are highlighted in bold. Among them, transactions, as promised, are zero-cost, which is a key competitive advantage.

The withdrawal of coins or tokens to fiat is charged at 2.5%. To be honest, we’re considering raising this figure to incentivize future users to stay in our cryptocurrency, but for now, we’ll keep it as is. We will also charge a 3% fee on all coin emissions from other companies participating in our blockchain. We will split this huge cash flow into equal parts – one and a half percent in fiat and the same in cryptocurrency. Finally, the overnight bank loans are also of interest in this list. The idea here is that we will concentrate significant financial assets in Nostro, which without overnight loans would remain stagnant. Our concept is that money should work and make another money, and overnight loans are the least risky operations in the interbank market.

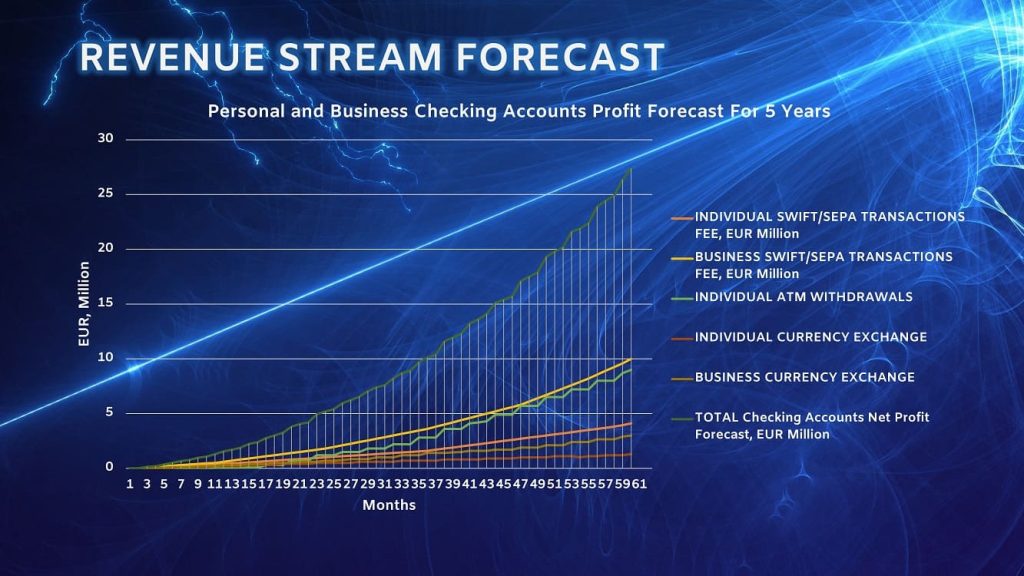

Next, let’s look at the profit from personal and business fiat accounts. The expected profit from fiat operations, including standard money transfers like SWIFT and SEPA, and currency exchange, will reach approximately 25 million by the fifth year.

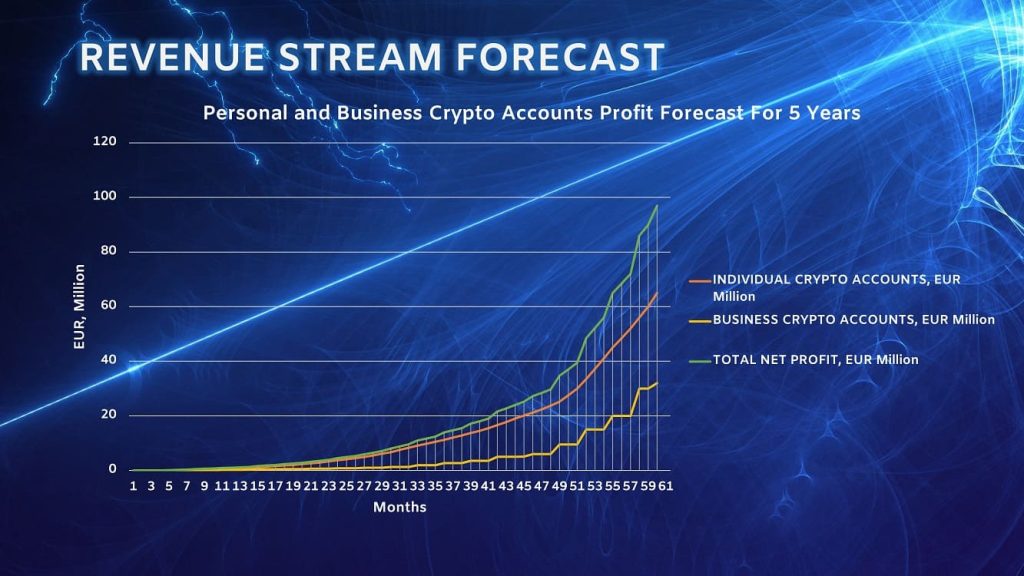

Next up are traditional cryptocurrencies, as well as traditional crypto services like margin trading, P2P transactions, or exchange.

Note that this chart is growing quite slowly; however, the magnitude of figures in crypto transfers is much larger than in traditional transactions, and personal transactions in terms of profit volume exceed those of corporate transactions. This is due to the current market structure with few business clients and Nostro’s key principle of transactional freedom for all clients, regardless of fiat or crypto transactions. We estimate our combined principle will bring about 100 million in net profit over five years.

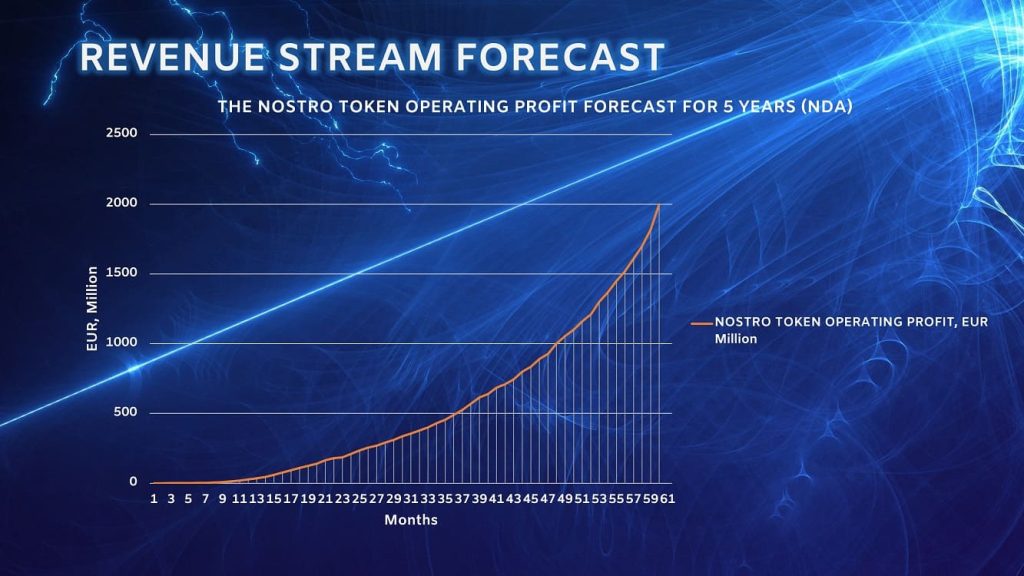

Well, now let’s delve into the most intriguing aspect, our company’s proprietary innovation – the Nostro Token. The expected operational profit from this token over five years will surpass two billion dollars. At this point, we want to emphasize that the forecasts you see are conservative, and we have tried to underestimate the potential profit as much as possible, based on the most conservative assumptions.

Of course, there’s a reason for this, and that reason is Nostro Coin. To understand where such significant profit comes from, let’s take a look at this asset.

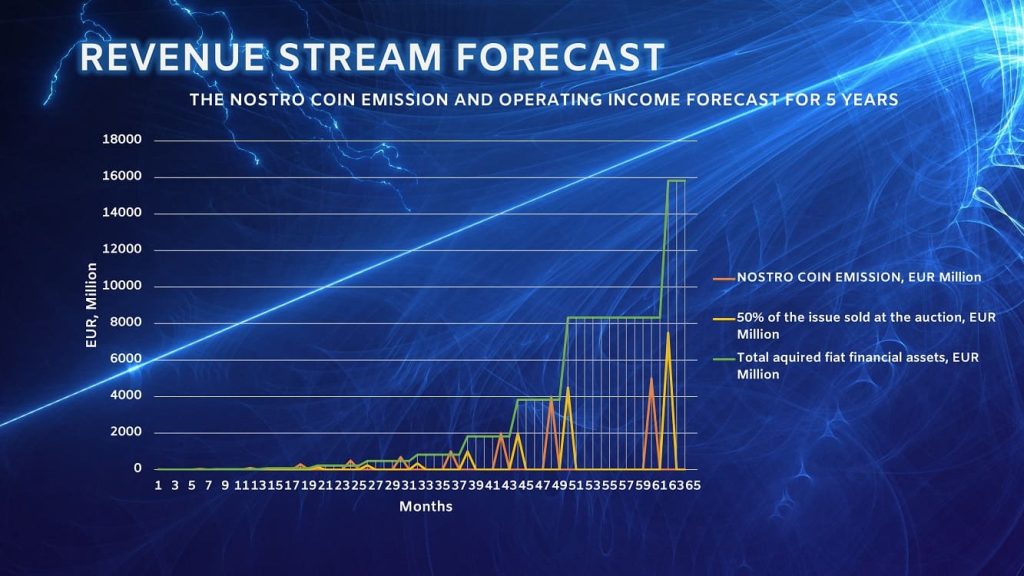

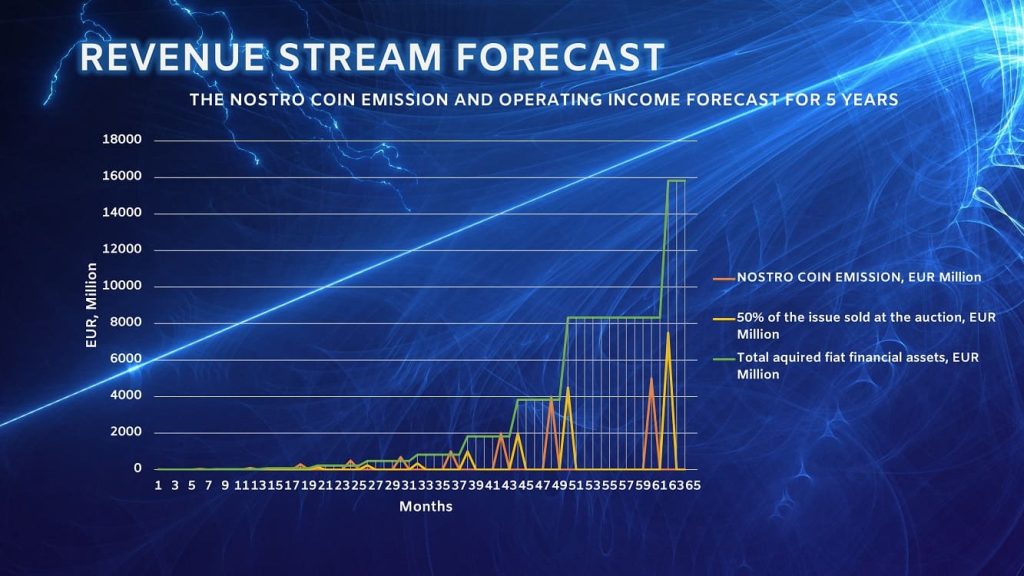

This is one of the most interesting charts. Look at the red line of the function, which represents the Coin issuance volume. Around the third year, the issuance will reach one billion euros in nominal value. However, according to the rules of the game, we will auction only 50% of the issuance, and we believe that at this point, the auction price of the coins (represented by the yellow line) will be approximately twice their nominal value, and by the end of the fifth year, it will start surpassing the nominal value by a third. Moreover, the market price of the N-coin will be even higher because the coin has a clearly defined practical use – it represents a merchant’s turnover. Additionally, the N-coin allows its holder to earn simply by leasing it. And that’s amazing. Look at the green line – it represents the total amount of funds acquired by the company in exchange for coins. By the end of the fifth year, this figure will exceed 16 billion.

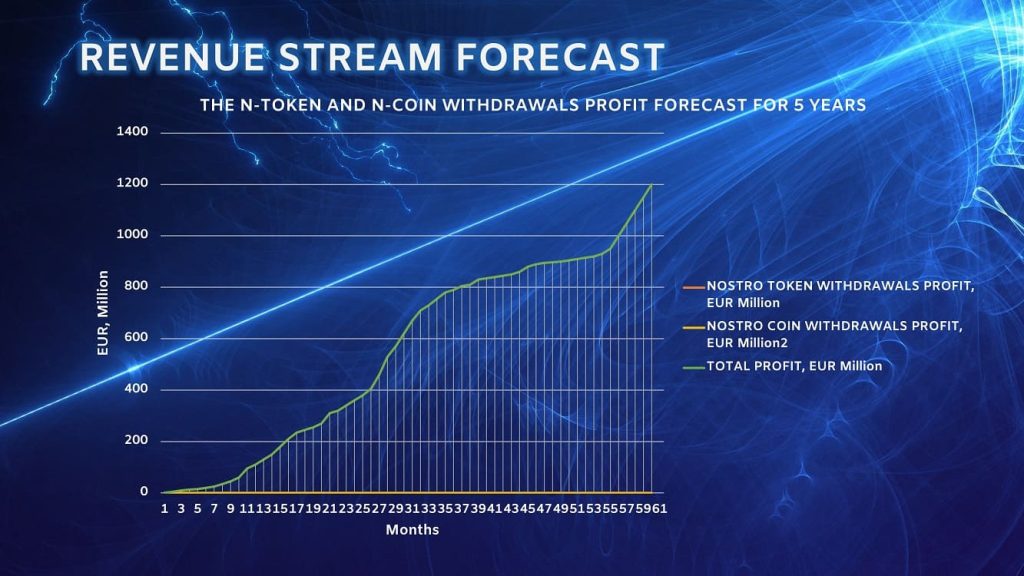

The next chart shows the potential profit from clients withdrawing N-tokens and N-coins into fiat currencies. Note that the total profit aligns with the profit from N-tokens, while the profit from converting N-coins into fiat is zero. This statement is based on the fact that holders of N-coin will never convert to fiat at the nominal price guaranteed by Nostro. Instead, they will sell the coin at market prices, significantly exceeding the nominal value of one euro per coin. It’s important to note that our business model guarantees 100% availability of fiat funds at all times, supporting both Nostro tokens and Nostro coins at the nominal value of one euro. In other words, if all clients decide to withdraw their tokens and coins to fiat simultaneously, Nostro will fulfill its obligations in full charging a 2.5% withdrawal fee. This model ensures solvency and eliminates bankruptcy risk since all other operations are inherently profitable and carry no additional risks.

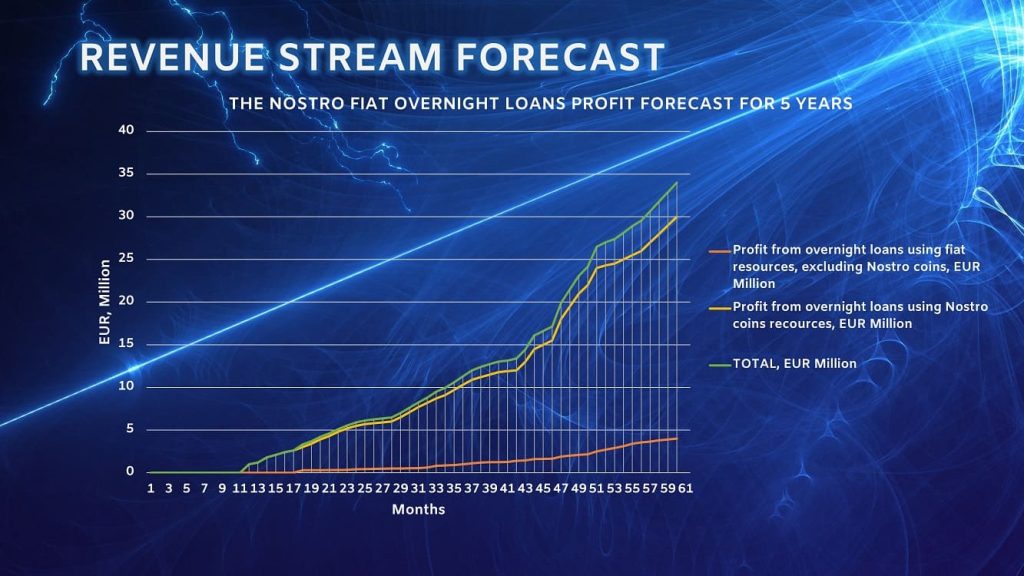

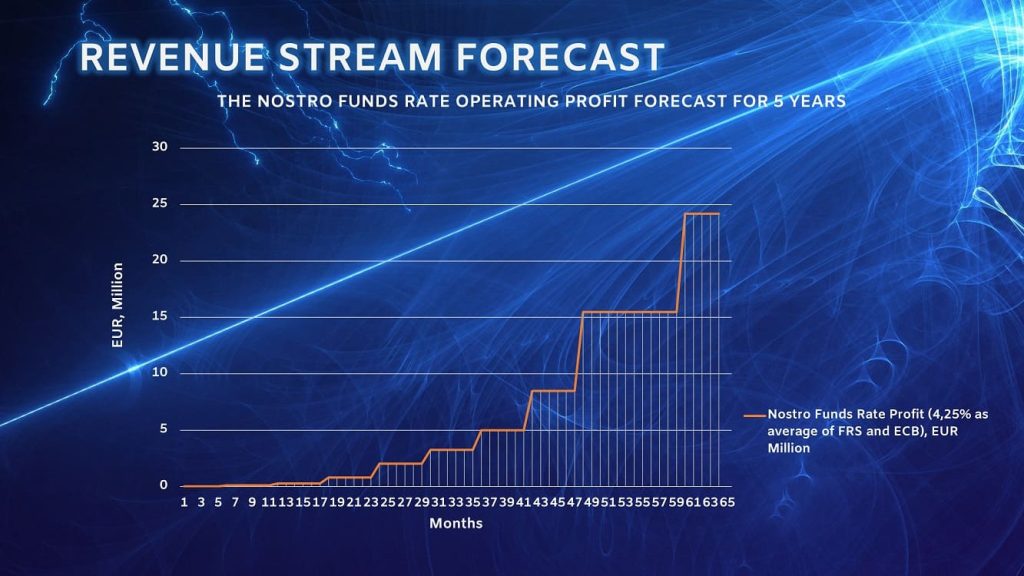

Take a look at the next graph. Given the huge amount of money that Nostro will start concentrating on its accounts, as well as the business model that excludes insolvency and guarantees clients the ability to convert tokens and coins to fiat at par value, overnight loans in the interbank market are a great opportunity to use this money supply. To calculate these values, we used an average between the key rates of the Fed and the ECB. According to our forecast, the profit from overnight loans issued at around 0.01 percent per day will reach 35 million dollars by the end of the fifth year.

As you may recall from our previous discussion, we are starting our challenge with a single funding rate known as the Nostro Funds Rate, which is equivalent to the same rates of the Federal Reserve System or the European Central Bank. Nostro Coin, which is necessary to complete the business transaction, can be borrowed at this rate from Nostro or at a commercial rate not lower than Nostro Funds Rate from other ecosystem participants.

So, let’s look at the graph. We’ve already seen this graph on a different scale when discussing half of the Nostro Coin issuance sold at auction. We show the second half of the issuance that will remain under our control in the current graph. Each jump of the green line on the graph represents the sum of all coins under our control and half of the new issuance coming under our control. Thus, by the end of the fifth year, we will have approximately 7 billion coins at a nominal value under our operational control, which we can use to influence market prices and for a commercial lease to fulfill business transactions.

It can be seen on that graph that the profit from coin lease transactions at our funding rate will be around 25 million. This figure more or less aligns with the profit from overnight loans and holds the same meaning when discussed in the cryptocurrency context.

Now let’s talk about the scalability of our blockchain. We’ve developed a mechanism that will grant equal rights and opportunities to all blockchain participants. However, who said that Nostro and our investors shouldn’t profit from this?

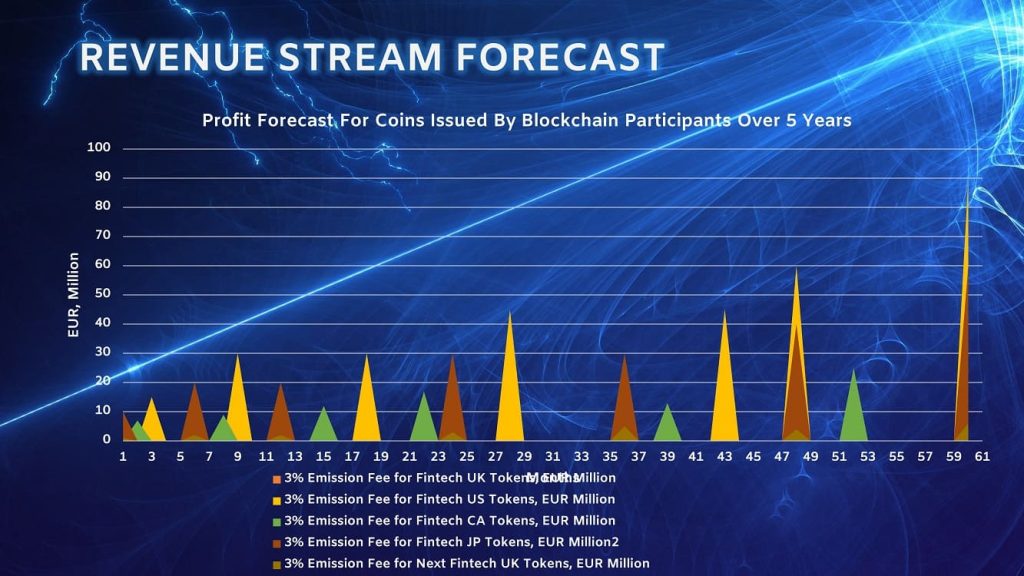

Take a look at this graph. Each area on this graph represents 3% of another fintech’s coins issuance that we will receive as a fee for conducting this issuance in our blockchain for other jurisdictions. The more participants, the more fiat currencies and crypto coins that represent these fiat currencies. The more coins blockchain participants emit, the more Nostro earns. We remind you that these are very conservative figures. For example, if players like JPMorgan Chase, BlackRock, Bank of America, and so on join our blockchain, their coin issuance could exceed hundreds of billions, not to mention non-financial companies that will also conduct their issuance. We won’t discuss the issuance mechanism in detail because this topic requires a separate presentation.

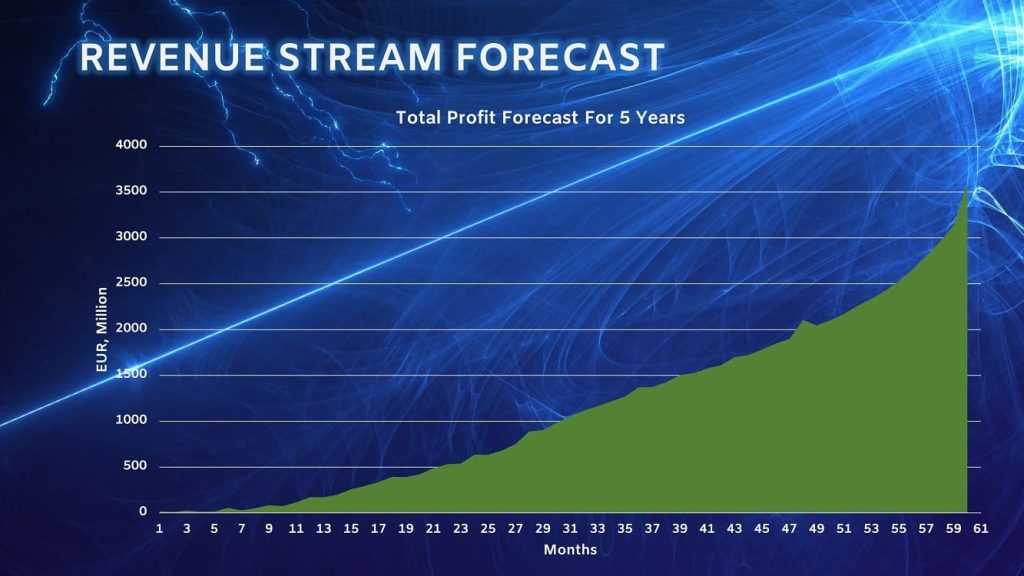

Let’s better take a closer look at the overall profit graph. We’ve decided not to include an intermediate chart showing the structure of this profit to avoid overwhelming you with details. Instead, we’ll conclude this slide with the overall profit graph, which, by conservative estimates, will exceed three and a half billion euros over 5 years. Please note that 2 billion from this graph is hidden under our NDA. However, even what we openly discuss amounts to one and a half billion euros over five years. Yes, we are fully confident that our startup is a unicorn, and we are looking forward to your investment to make this possible.

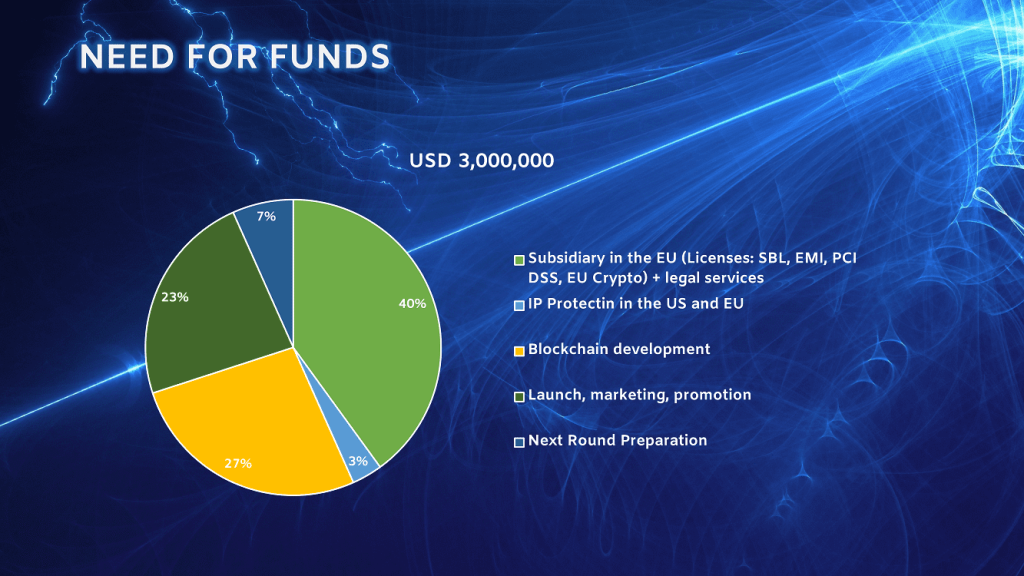

Need For Funds

We need to attract 3 million at this stage. The lion’s share of the expenses is the authorized capital and the legal structure, which implies obtaining a limited banking license in Lithuania known as SBL, together with EMI, PCI DSS, and Crypto licenses. This is the cheapest option in the European Union with acceptable taxes, allowing us to create a full-fledged online fintech that implements our business plan. An important feature is that the authorized capital will remain on the company’s balance sheet, supporting its liquidity following the law. In other words, these are investor funds that will not actually be spent.

Protecting intellectual property will cost us approximately $100,000, but it will create an intangible asset on which the company’s capitalization growth will be based.

The next expense item, alongside the legal aspect, is blockchain development, the main vehicle of the Nostro Ecosystem and future tokenomics.

We also have a market entry strategy focused on business clients. We estimate the cost of this strategy to be approximately $700,000.

And finally, $200,000 is allocated for preparation for the next investment round. According to our Gantt chart, all these processes are running in parallel.

At the moment, we can enter the market without attracting additional investments. However, in this case, we will be just another company offering traditional cryptocurrency services on the market. Let’s put it this way, we will become a thousandth copy of Binance or Coinbase. This strategy of hopelessness will bury the project and prevent the company from becoming a unicorn. For Nostro to take off, we must enter the market with at least an offer of full freedom for fiat and crypto transactions. Even entering the market with the services described in the Quick Competition Test will already make our company a market leader.

Offer And Exit Strategies

We offer a 10% equity stake in the company in exchange for USD 3M in capital. Small investments are encouraged. Since we aim to engage as many stakeholders in our process as possible, we believe this policy will make us more prominent from the very first moments of our existence.

We provide four exit strategies: Buyback, Liquidity, Go-Public, and Crypto. Buyback involves repurchasing shares, a classic strategy. Offering 10% of the company in the current round, we plan to repurchase 2.5% in the next round. Liquidity offers quick share selling, ideal for those seeking assurance in liquidity and accommodating small investments. Crypto appeals to visionaries excited about cryptocurrency’s future beyond just a successful exit. Finally, we consider IPO and its variations. Additionally, we welcome your ideas for review, investigation, and potential implementation.